Reading: The Great Depression

The Great Depression

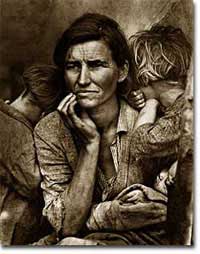

Dorothea Lange was employed by the Farm Security Administration to document the Depression through the camera lens. Her bleak photos captured the desperation of the era, as evidenced through this portrait of an 18-year-old migrant worker and her child.

"Once I built a railroad, I made it run.

I made it race against time.

Once I built a railroad, now it's done.

Brother, can you spare a dime?"

At the end of the 1920s, the United States boasted the largest economy in the world. With the destruction wrought by World War I, Europeans struggled while Americans flourished. Upon succeeding to the Presidency, Herbert Hoover predicted that the United States would soon see the day when poverty was eliminated. Then, in a moment of apparent triumph, everything fell apart. The stock market crash of 1929 touched off a chain of events that plunged the United States into its longest, deepest economic crisis of its history.

Nine thousand banks failed during the months following the stock market crash of 1929.

It is far too simplistic to view the stock market crash as the single cause of the Great Depression. A healthy economy can recover from such a contraction. Long-term underlying causes sent the nation into a downward spiral of despair. First, American firms earned record profits during the 1920s and reinvested much of these funds into expansion. By 1929, companies had expanded to the bubble point. Workers could no longer continue to fuel further expansion, so a slowdown was inevitable. While corporate profits, skyrocketed, wages increased incrementally, which widened the distribution of wealth.

The richest one percent of Americans owned over a third of all American assets. Such wealth concentrated in the hands of a few limits economic growth. The wealthy tended to save money that might have been put back into the economy if it were spread among the middle and lower classes. Middle class Americans had already stretched their debt capacities by purchasing automobiles and household appliances on installment plans.

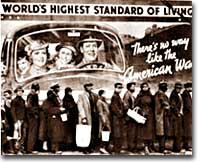

The unprecedented prosperity of the 1920s was suddenly gone, the Great Depression was upon the nation, and breadlines became a common sight.

There were fundamental structural weaknesses in the American economic system. Banks operated without guarantees to their customers, creating a climate of panic when times got tough. Few regulations were placed on banks and they lent money to those who speculated recklessly in stocks. Agricultural prices had already been low during the 1920s, leaving farmers unable to spark any sort of recovery. When the Depression spread across the Atlantic, Europeans bought fewer American products, worsening the slide.

When President Hoover was inaugurated, the American economy was a house of cards. Unable to provide the proper relief from hard times, his popularity decreased as more and more Americans lost their jobs. His minimalist approach to government intervention made little impact . The economy shrank with each successive year of his Presidency. As middle class Americans stood in the same soup lines previously graced only by the nation's poorest, the entire social fabric of America was forever altered.

"BROTHER, CAN YOU SPARE A DIME?"

The Market Crashes

The Roaring '20s came to a screeching halt when the stock market took a historic nosedive at the end of the decade. Here, a nervous crowd gathers in front of the New York Stock Exchange on October 29, 1929.

It was a boom time for the STOCKHOLDER.STOCK PRICES soared to record levels. Millionaires were made overnight. Sound like the stock market of the 1990s? Try the New York Stock Exchange on the eve of the GREAT CRASH in 1929.

Although the 1920s were marked by growth in stock values, the last four years saw an explosion in the market. In 1925, the total value of the NEW YORK STOCK EXCHANGE was $27 billion. By September 1929, that figure skyrocketed to $87 billion. This means that the average stockholder more than tripled the value of the stock portfolio he or she was lucky enough to possess.

In his LADIES' HOME JOURNAL article, "Everyone Ought to Be Rich," wealthy financier JOHN J. RASKOB advised Americans to invest just $15 dollars a month in the market. After twenty years, he claimed, the venture would be worth $80,000. Stock fever was sweeping the nation, or at least those that had the means to invest.

Fueling the rapid expansion was the risky practice of buying stock on margin. A MARGIN PURCHASE allows an investor to borrow money, typically as much as 75% of the purchase price, to buy a greater amount of stock. Stockbrokers and even banks funded the reckless SPECULATOR. Borrowers were often willing to pay 20% interest rates on loans, being dead certain that the risk would be worth the rewards. The lender was so certain that the market would rise that such transactions became commonplace, despite warnings by the Federal Reserve Board against the practice. Clearly, there had to be a limit to how high the market could reach.

On October 24, 1929, a day that came to be known as Black Thursday, investors began to sell their stocks at an alarming rate. By October 29, the Great Crash was underway, and by November 17, over $30 billion dollars had disappeared from the U.S. economy. In the chart above, the horizontal axis represents the years 1921-40, and the vertical axis represents the Dow Jones Industrial Average.

What causes stock prices to fall? Although the workings of the New York Stock Exchange can be quite complex, one simple principle governs the price of stock. When investors believe a stock is a good value they are willing to pay more for a share and its value rises. When traders believe the value of a security will fall, they cannot sell it at as high of a price. If all investors try to sell their shares at once and no one is willing to buy, the value of the market shrinks.

Wealthy investors like J.P. Morgan hoped to stop the crash by pooling their resources and buying up large amounts of stock.

On October 24, 1929, "BLACK THURSDAY," this massive sell-a-thon began. By the late afternoon, wealthy financiers like J.P. Morgan pooled their resources and began to buy stocks in the hopes of reversing the trend.

But the bottom fell out of the market on Tuesday, October 29. A record 16 million shares were exchanged for smaller and smaller values as the day progressed. For some stocks, no buyers could be found at any price. By the end of the day, panic had erupted, and the next few weeks continued the downward spiral. In a matter of ten short weeks the value of the entire market was cut in half. Suicide and despair swept the investing classes of America.

Sinking Deeper and Deeper: 1929-33

This photo, taken by Dorothea Lange, is one of the Depression's most well-known images. The woman, Florence Thompson, is shown with her children in a migrant farm worker camp in California.

When the stock market crashed on October 29, 1929, few Americans believed that a decade long depression was underway. After all, only 4 million Americans had money invested on Wall Street. 90% of American households owned precisely zero shares of stock. President Herbert Hoover quickly addressed the nation, professing his faith in the soundness of the American economy. But soothing words were clearly not enough to stop the shrinking of a deeply flawed national economic system.

The stock market crash had many short-term consequences. Banks that improvidently lent money to futures traders to buy stock on margin found that many of those loans would go unpaid. Consequently, a rash of BANK FAILURESswept the nation. This had a tremendous ripple effect on the economy. If a working-class family was unfortunate enough to have their savings held in trust by a failed bank — too bad for them, all their money was lost.

As Americans saw banks close and savings disappear, less money was spent on goods and services. Many consumers who had bought the new conveniences of the GOLDEN TWENTIES on the installment plan were unable to make their payments. Businesses began to lay off workers to offset new losses. Many manufacturers had overproduced and created huge inventories.

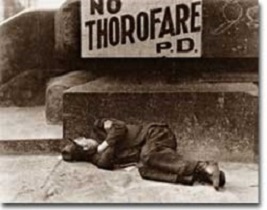

During the 1930s, photographer Imogen Cunningham documented the lives of the destitute of Oakland, California. This print is entitled "Under the Queensborough Bridge."

Unemployment brought even less savings and spending, and the economy slowed yet another notch. The downward spiral continued into 1933. The $87 billion 1929 New York Stock Exchange was worth a mere $15 billion in 1932. UNEMPLOYMENTrose from 1.5 million Americans in 1929 to a debilitating 12 million in 1932.

Despair swept the nation. In addition to the nationwide 25% unemployment rate, many laborers were forced to choose between wage cuts and a PINK SLIP. Most people who retained their jobs saw their incomes shrink by a third. SOUP KITCHENS and CHARITY LINES, previously unknown to the middle class, were unable to meet the growing demand for food.

Desperate for income, thousands performed odd jobs from taking in laundry to collecting and selling apples on the street. College professors in New York City drove taxicabs to make ends meet. Citizens of Washington State lit forest fires in the hopes of earning a few bucks extinguishing them. Millions of backyard gardens were cultivated to grow vegetables.

First published in 1939, John Steinbeck's novel The Grapes of Wrath told of the Joad family's loss of their Oklahoma tenant farm and the hardships they encountered while trying to reach California and start anew.

Americans prowled landfills waiting for the next load of refuse to arrive in the hopes of finding a few table scraps among the trash.

The strife was uneven across the land. Oklahoma was particularly hard hit, as aDROUGHT brought dry winds, kicking up a"DUST BOWL" that forced thousands to migrate westward. African Americans endured unemployment rates of nearly twice the white communities, as African American workers were often the last hired and the first fired. Mexican Americans in California were offered free one-way trips back to Mexico to decrease job competition in the state. The Latino population of the American Southwest sharply decreased throughout the decade, as ethnic violence increased.

As the days and weeks of the GREAT DEPRESSION turned into months and years, Americans began to organize their discontent.

The Bonus March

World War I veterans block the steps of the Capitol during the Bonus March, July 5, 1932.

Many in America wondered if the nation would survive.

Although the United States had little history of massive social upheaval or coup attempts against the government, hunger has an ominous way of stirring those passions among any population. As bread riots and shantytowns grew in number, many began to seek alternatives to the status quo. Demonstrations in the nation's capital increased, as Americans grew increasingly weary with President Hoover's perceived inaction. The demonstration that drew the most national attention was theBONUS ARMY MARCH of 1932.

In 1924, Congress rewarded VETERANS of WORLD WAR I with certificates redeemable in 1945 for $1,000 each. By 1932, many of these former servicemen had lost their jobs and fortunes in the early days of the Depression. They asked Congress to redeem their BONUS CERTIFICATES early.

Workers and their unions fought poor working conditions by walking off the job. Violence often erupted when factory owners tried to break the "strike." These broken windows are a result of the Flint, Michigan, sit-down strike of 1936-37.

Led by WALTER WATERS of Oregon, the so-called Bonus Expeditionary Force set out for the nation's capital. Hitching rides, hopping trains, and hiking finally brought the Bonus Army, now 15,000 strong, into the capital in June 1932. Although President Hoover refused to address them, the veterans did find an audience with a congressional delegation. Soon a debate began in the Congress over whether to meet the demonstrators' demands.

As deliberation continued on Capitol Hill, the Bonus Army built a SHANTYTOWN across the Potomac River inANACOSTIA FLATS. When the Senate rejected their demands on June 17, most of the veterans dejectedly returned home. But several thousand remained in the capital with their families. Many had nowhere else to go. The Bonus Army conducted itself with decorum and spent their vigil unarmed.

Conditions during the Depression were so bad that some city governments devised programs that had the unemployed selling apples to make a living. This man was one of nearly 700 apple vendors in Detroit.

However, many believed them a threat to national security. On July 28, Washington police began to clear the demonstrators out of the capital. Two men were killed as tear gas and bayonets assailed the Bonus Marchers. Fearing rising disorder, Hoover ordered an army regiment into the city, under the leadership of General Douglas MacArthur. The army, complete with infantry, cavalry, and tanks, rolled into Anacostia Flats forcing the Bonus Army to flee. MacArthur then ordered the shanty settlements burned.

Many Americans were outraged. How could the army treat veterans of the Great War with such disrespect? Hoover maintained that political agitators, anarchists, and communists dominated the mob. But facts contradict his claims. Nine out of ten Bonus Marchers were indeed veterans, and 20% were disabled. Despite the fact that the Bonus Army was the largest march on Washington up to that point in history, Hoover and MacArthur clearly overestimated the threat posed to national security. As Hoover campaigned for reelection that summer, his actions turned an already sour public opinion of him even further bottomward.

America sank deeper in Depression.

Hoover's Last Stand

The Great Depression did not spare the most vulnerable citizens. The Bonus Army's protest of 1932 made this point by including families with young children in its march on and encampment in Washington, D.C.

PRESIDENT HERBERT HOOVER had the distinction of stepping into the White House at the height of one of the longest periods of growth in American history. Less than seven months after his inauguration, the worst depression in American history began.

Undoubtedly, the fault of the Great Depression was not Hoover's. But as the years of his Presidency passed and the country slipped deeper and deeper into its quagmire, he would receive great blame. Urban shantytowns were dubbed HOOVERVILLES. Newspapers used by the destitute as bundling for warmth became known as Hoover blankets. Pockets turned inside out were called Hoover flags. Somebody had to be blamed, and many Americans blamed their President.

Running for President under the slogan "RUGGED INDIVIDUALISM" made it difficult for Hoover to promote massive government intervention in the economy. In 1930, succumbing to pressure from American industrialists, Hoover signed the HAWLEY-SMOOT TARIFF which was designed to protect American industry from overseas competition. Passed against the advice of nearly every prominent economist of the time, it was the largest TARIFF in American history.

A robust, young Herbert Hoover, posed with his dog "King Tut" in a photograph used in the 1928 presidential campaign.

The amount of protection received by industry did not offset the losses brought by a decrease in foreign trade. The Hawley-Smoot Tariff proved to be a disaster. Believing in a balanced budget, Hoover's 1931 economic plan cut federal spending and increased taxes, both of which inhibited individual efforts to spur the economy.

Finally in 1932 Hoover signed legislation creating the Reconstruction Finance Corporation. This act allocated a half billion dollars for loans to banks, corporations, and state governments. Public works projects such as the GOLDEN GATE BRIDGE and the Los Angeles Aqueduct were built as a result of this plan.

Hoover and the RFC stopped short of meeting one demand of the American masses — federal aid to individuals. Hoover believed that government aid would stifle initiative and create dependency where individual effort was needed. Past governments never resorted to such schemes and the economy managed to rebound. Clearly Hoover and his advisors failed to grasp the scope of the Great Depression.

Completed in 1937, the Golden Gate Bridge was a result of President Herbert Hoover's Reconstruction Finance Corporation. Its art-deco design reflects the opulent style of the 1920s.

The stage was set for the ELECTION OF 1932. New York Governor Franklin D. Roosevelt won the Democratic nomination on the fourth ballot of their national convention. Roosevelt promised "a new deal for the American people" that included a repeal of the prohibition amendment. The Republicans renominated Hoover, perhaps because there were few other interested GOP candidates.

Election day brought a landslide for the Democrats, as Roosevelt earned 58% of the popular vote and 89% of the electoral vote, handing the Republicans their second-worst defeat in their history. Bands across America struck up Roosevelt's theme song — "HAPPY DAYS ARE HERE AGAIN" — as millions of Americans looked with hope toward their new leader.

48e. Social and Cultural Effects of the Depression

Sports provided a distraction from the Depression. Shown is a ticker tape parade held in honor of the Detroit Tigers after winning the 1935 World Series.

No nation could emerge from the cauldron of national crisis without profound social and cultural changes. While many undesirable vices associated with hopelessness were on the rise, many family units were also strengthened through the crisis. MASS MIGRATIONSreshaped the American mosaic. While many businesses perished during the Great Depression, others actually emerged stronger. And new forms of expression flourished in the culture of despair.

The Great Depression brought a rapid rise in the CRIME RATE as many unemployed workers resorted to petty theft to put food on the table. Suicide rates rose, as did reported cases of malnutrition. Prostitution was on the rise as desperate women sought ways to pay the bills. Health care in general was not a priority for many Americans, as visiting the doctor was reserved for only the direst of circumstances. Alcoholism increased with Americans seeking outlets for escape, compounded by the repeal of prohibition in 1933. Cigar smoking became too expensive, so many Americans switched to cheaper cigarettes.

Higher education remained out of reach for most Americans as the nation's universities saw their student bodies shrink during the first half of the decade. High school attendance increased among males, however. Because the prospects of a young male getting a job were so incredibly dim, many decided to stay in school longer. However, public spending on education declined sharply, causing many schools to open understaffed or close due to lack of funds.

Demographic trends also changed sharply. Marriages were delayed as many males waited until they could provide for a family before proposing to a prospective spouse. Divorce rates dropped steadily in the 1930s. Rates of abandonment increased as many husbands chose the "poor man's divorce" option — they just ran away from their marriages. Birth rates fell sharply, especially during the lowest points of the Depression. More and more Americans learned about birth control to avoid the added expenses of unexpected children.

Mass migrations continued throughout the 1930s. Rural New England and upstate New York lost many citizens seeking opportunity elsewhere. TheGREAT PLAINS lost population to states such as California and Arizona. The Dust Bowl sent thousands of "OKIES" and "ARKIES" looking to make a better life. Many of the MIGRANTS were adolescents seeking opportunity away from a family that had younger mouths to feed. Over 600,000 people were caught hitching rides on trains during the Great Depression. Many times offenders went unpunished.

Films like The Bride of Frankenstein (1935) entertained Americans by the thousands despite the hardships brought by the Great Depression.