Reading: Financial Statements

The

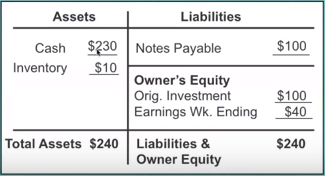

Balance Sheet

•The

Balance Sheet describes a business’s financial situation at a moment in time,

or a snap shot

•The

left side details the assets a business owns

•The

right side details how those assets were acquired (Liabilities + Shareholder

Equity)

Both

sides must always equalHow

Loans Effect a Balance Sheet

•You

need a loan to help fund your business

•The

bank lends you $100 and expects and interest payment of 10%

•A

long term loan that includes interest known as Notes Payable

Two

Types of Owners

•People

the business owes money to (Liabilities)

•The

part of the business the owner owns (Owner’s Equity)

Assets

= Liabilities + Owner’s EquityInventory

and The Balance Sheet

•Inventory

consists of products that you sell.

•When

you buy inventory you decrease the value of your cash.

•$50

of inventory buys you:

- $ 35 for 50 sheets of paper

- $15 in markers and colored pencils

- $ 35 for 50 sheets of paper

- $15 in markers and colored pencils

First

Day in Business

•You

draw 40 caricatures for $2 a piece

•$80

in total sales

•Unit

Cost = Price of inventory to create 1 finished good

- $50 in inventory produces 50 caricatures

- $50 in inventory produces 50 caricatures

•Cost

of Goods Sold ($40) = Units Sold (40) * Unit Cost ($1)

•Gross

Profit ($40) = Sales ($80) – COGS ($40)

Record

First Day on Balance Sheet

•Cash

$230 = Prev. Cash $200 – Inventory $50 + Sales $80

•EWD

$40 = Sales $80 – COGS $40

Time

to Expand

•You

increase your price to $5 per caricature

•Rent

a space at the mall for $80 per day

•Buy

a sign and easel for $50

•Buy

$50 in raw material inventory

Sell

60 caricatures for $300 in salesExplain

the Changes

•Cash

$350 = Prev Cash

$230 – Expenses $130 – Inventory $50 + Sales $300

Earnings

Week Ending $110 = Expenses -$130 – COGS $60 + Sales $300Second

Week in Business

•You

decide to rent the mall booth for 3 days $240

•Spend

$150 on Raw Materials

•Use

$25 of Raw Materials to create Picture Books

•You

sell 125 caricatures, but no picture books

Income

Statement from Weekend

•Remember

to subtract ending inventory

•Move

Net Profit to Earnings Week to Date.

Over

to the Balance Sheet

•Cash

$585 = Prev. Cash $350 – Inventory $150 – Rent $240 + Sales $625

•EWTD

$260 = Sales $625 – COGS $125 – Expenses $240

•Finished

Goods

•Retained

Earnings

One

Last Development

•Friend

offers to buy picture books for $50 on credit (Accounts Receivable)

•Mall

operator wants ½ up front $120 (Pre Paid Expense)

•Check

into Accounts Payable

What

Happens if Debt isn’t Paid

•Remove

amounts in Accounts Receivable

•Delete

the same amount from Earnings Week to Date.

Don’t

touch Retained EarningsÚltima modificación: martes, 14 de agosto de 2018, 08:29