Reading: Capital Asset Pricing Model

Capital

Asset Pricing Model (CAPM)

•Expected

Return on the Market - The expected market return is an important concept in

risk management, because it is used to determine the market risk premium. The

market risk premium, in turn, is part of the capital asset pricing model,

(CAPM) formula. This formula is used by investors, brokers and financial

managers to estimate the reasonable expected rate of return on a given

investment.

•Expected

Return on an Individual Security – process similar to expected market

return, only difference is that it is finding an asset price for a single

security.

Expected

Return on the Market

If the risk-free rate, estimated by the current yield on a one-year Treasury bill,

is 4.96 percent, and the risk premium is

1.39 percent the expected on the market

is:

Expected

Return on an Individual Security

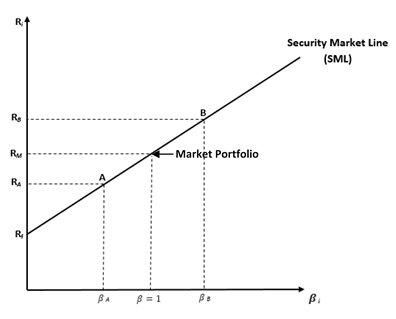

•The

Security Market Line (SML) is the graphical depiction of the capital asset

pricing model (CAPM)

•The

expected return on a security with a beta of 0 is equal to the risk-free rate.

•The

expected return on a security with a beta of 1 is equal to the expected return

on the market.

Expected

Return on an Individual Security

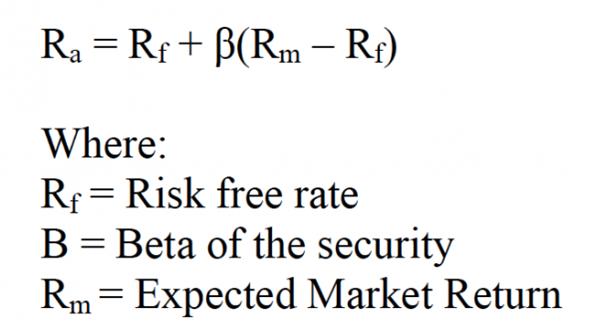

This is the Capital Asset Pricing Model (CAPM)

CAPM

Example

•The

shares of Aardvark Enterprises have a beta of 0.7. The risk-free rate is

assumed 3%, and the difference between expected return on the market and the

risk-free rate is assumed to be 8.0%. What are the expected return on the two

securities?

•

Aardvark expected return:

15.0% = 3% + 1.5 x 8.0%

Zebra expected return:

8.6% = 3% + 0.7 x 8.0%

Última modificación: martes, 14 de agosto de 2018, 08:45