Reading: Understanding Present Value

Present

Value And Discounting

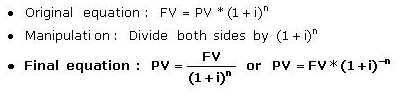

Present value, also called "discounted value," is the current worth of a future sum of money or stream of cash flow given a specified rate of return. Future cash flows are discounted at the discount rate; the higher the discount rate, the lower the present value of the future cash flows. Determining the appropriate discount rate is the key to properly valuing future cash flows, whether they are earnings or obligations. If you received $10,000 today, the present value would be $10,000 because present value is what your investment gives you if you were to spend it today. If you received $10,000 in a year, the present value of the amount would not be $10,000 because you do not have it in your hand now, in the present. To find the present value of the $10,000 you will receive in the future, you need to pretend that the $10,000 is the total future value of an amount that you invested today. In other words, to find the present value of the future $10,000, we need to find out how much we would have to invest today in order to receive that $10,000 in the future.

To

calculate present value, or the amount that we would have to invest today, you

must subtract the (hypothetical) accumulated interest from the $10,000. To

achieve this, we can discount the future payment amount ($10,000) by the

interest rate for the period. In essence, all you are doing is rearranging the

future value equation above so that you may solve for P. The above future value

equation can be rewritten by replacing the P variable with present

value (PV)

and manipulating the equation as follows: