Reading: Efficient Markets

Random

Walks and Efficient Markets

Random

Walk: the theory that stock price movements are unpredictable, so there is no way to know where prices are

headed.

- Studies of stock price movements indicate that they do not move in neat

patterns

- This random pattern is a natural outcome of markets that are highly efficient

and respond quickly to changes in material information

Random Walk

Efficient Markets

•Efficient

Market: a market in which securities reflect all possible information quickly

and accurately.

•To

have an efficient market, you must have:

- Many knowledgeable investors actively analyzing and trading stocks

- Information is widely available to all investors

- Events, such as labor strikes or accidents, tend to happen randomly

- Investors react quickly and accurately to new information

- Many knowledgeable investors actively analyzing and trading stocks

- Information is widely available to all investors

- Events, such as labor strikes or accidents, tend to happen randomly

- Investors react quickly and accurately to new information

Efficient

Market Hypothesis

•Efficient

Market Hypothesis (EMH): information is reflected in prices – not only the type

and source of information, but also the quality and speed with which it is

reflected in prices. The more information that is incorporated into prices, the

more efficient the market becomes.

•Levels

of EMH

-Weak Form EMH

-Semi-strong Form EMH

-Strong Form EMH

-Weak Form EMH

-Semi-strong Form EMH

-Strong Form EMH

Weak

Form of EMH

•Weak

Form of EMH

- Past data on stock prices are of no use in predicting future stock price changes

- Everything is random

- Should simply use a “buy and hold” strategy

- Past data on stock prices are of no use in predicting future stock price changes

- Everything is random

- Should simply use a “buy and hold” strategy

Semi-strong

Form of EMH

•Semi-strong

Form EMH

- Abnormally large profits cannot be consistently earned using public information.

- Any price anomalies are quickly found out and the stock market adjusts

- Abnormally large profits cannot be consistently earned using public information.

- Any price anomalies are quickly found out and the stock market adjusts

Strong

Form of EMH

•Strong

Form EMH

- There is no information, public of private, that allows investors to consistently earn abnormally high returns.

- Seems to be evidence that the market is not strong form efficient

-Reason for inside trading laws

- There is no information, public of private, that allows investors to consistently earn abnormally high returns.

- Seems to be evidence that the market is not strong form efficient

-Reason for inside trading laws

Market

Anomalies

•Calendar

Effects

- Stock returns may be closely tied to the time of year or time of week.

- Questionable if really provides opportunity

- Examples: January Effect, weekend effect

- Stock returns may be closely tied to the time of year or time of week.

- Questionable if really provides opportunity

- Examples: January Effect, weekend effect

•Small-Firm

Effect

- Size of a firm impacts stock returns

- Small firms may offer higher returns than larger firms, even after adjusting for risk

- Size of a firm impacts stock returns

- Small firms may offer higher returns than larger firms, even after adjusting for risk

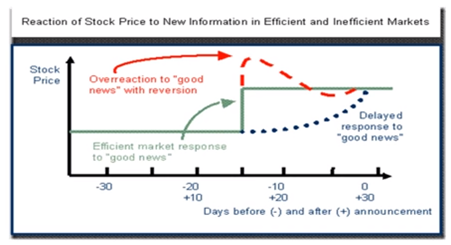

•Earnings

Announcements

- Stock price adjustments may continue after earnings adjustments have been announced

- Unusually good quarterly earnings reports may signal buying opportunity

- Stock price adjustments may continue after earnings adjustments have been announced

- Unusually good quarterly earnings reports may signal buying opportunity

•P/E

Effect (Value Effect)

- Uses P/E ratio to value stocks

- Low P/E stocks may outperform high P/E stocks, even after adjusting for risk

- Uses P/E ratio to value stocks

- Low P/E stocks may outperform high P/E stocks, even after adjusting for risk

Остання зміна: вівторок 14 серпня 2018 10:13 AM