Reading: Introduction to Corporate Finance

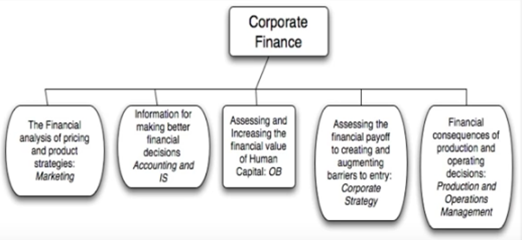

What

is Corporate Finance?

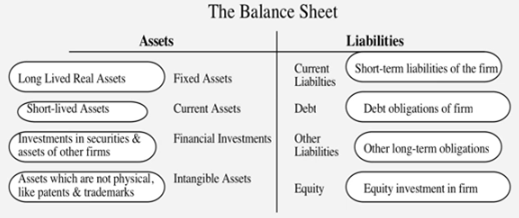

The

Traditional Accounting Balance Sheet

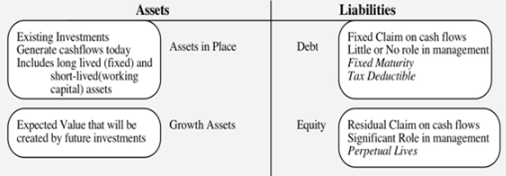

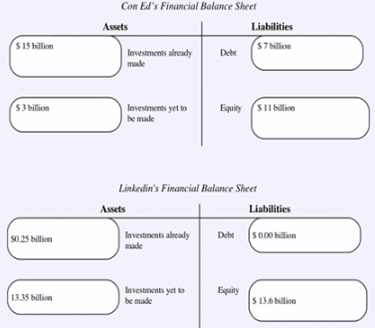

The

Financial View of the Firm

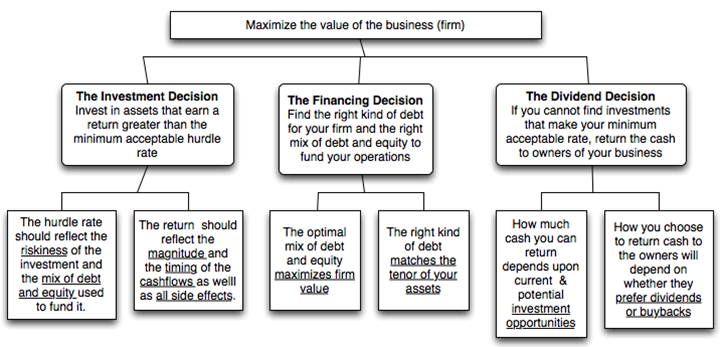

First

Principles & The Big Picture

Corporate

Finance is “Common Sense”

•There

is nothing earth shattering about any of the first principles that govern

corporate finance. After all, arguing that making a business investment that

yields 9%, while cost of financing the investment is 10%, which is better than

finance costs at 11%.

•Finance

managers should recognize if the cost of financing an investment is greater

than the return on the investment, then the firm should not make the

investment.

•Then

firm can then consider what next to do with the free cash flow. Choose another

investment option that is more advantageous for the firm, or return the excess

capital back to shareholders.

Corporate

Finance is Focused

Corporate finance focuses on maximizing

the value of a firm. As a result of the this singular objective finance

managers can:

•Choose

the “correct” investment strategy given various investment decision rules.

•Determine

the “correct” mix of debt and equity financing for a specific business

•Examine

the “correct” amount of cash that should be returned to shareholders and the

“correct” amount of cash to reserve in retained earnings.

The

Focus Changes Across the Life Cycle

Corporate

Finance is Universal

•Every

business, small or large, public or private, US or emerging market, has to make

investment, financing and dividend decisions.

•While

the constraints and challenges that firms face can vary dramatically across

firms, the first principles do not change.

- A publicly traded firm has greater access to capital markets and a more diversified investor base, may have a much lower cost of debt and equity than a private business, but both should look for the financing mix that minimizes their cost of capital

- A firm in an emerging market may face the greater uncertainty when assessing new investments than a firm in a developed market. Both firms should invest only if they believe they can generate higher returns on their investments than they face their respective, and very different hurdles.

- A publicly traded firm has greater access to capital markets and a more diversified investor base, may have a much lower cost of debt and equity than a private business, but both should look for the financing mix that minimizes their cost of capital

- A firm in an emerging market may face the greater uncertainty when assessing new investments than a firm in a developed market. Both firms should invest only if they believe they can generate higher returns on their investments than they face their respective, and very different hurdles.

Last modified: Tuesday, August 14, 2018, 8:36 AM