Reading: Financial Statement Analysis

Basic

Financial Statements

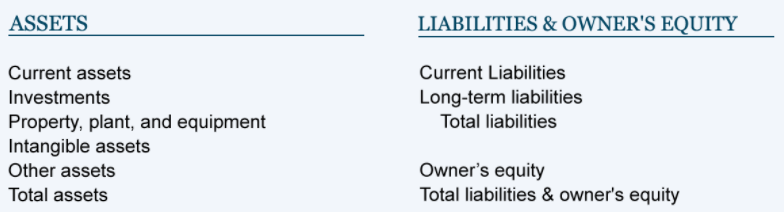

•The

Balance Sheet – summarizes what a firm owns and owes at a given point in

time.

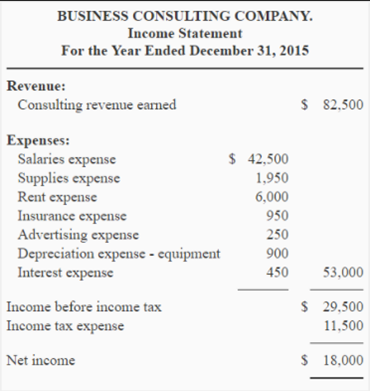

•The

Income Statement – reports on how much a firm earned in the period of analysis.

•The

Statement of Cash Flows – reports on cash inflows and outflows to the firm

during the point of analysis

Balance

Sheet

Principles

Underlying Balance Sheets

•An

abiding belief in book value as the best estimate of nominal value.

-Unless there is a substantial reason to do otherwise, accountants view the historical cost as the best estimate of the value of an asset.

-Unless there is a substantial reason to do otherwise, accountants view the historical cost as the best estimate of the value of an asset.

•A

distrust of the market of estimated value.

-The market price of an asset is often viewed as both much too volatile and too easily manipulated to be used as an estimate of value for an asset. This suspicion runs even deeper when values are estimated on future cash flows.

-The market price of an asset is often viewed as both much too volatile and too easily manipulated to be used as an estimate of value for an asset. This suspicion runs even deeper when values are estimated on future cash flows.

•A

preference for under estimating value rather than over estimating.

- When there is more than one approach to valuing an asset. An accounting approach takes a view that assets should be valued more conservative than market valuation, which less conservative.

- When there is more than one approach to valuing an asset. An accounting approach takes a view that assets should be valued more conservative than market valuation, which less conservative.

Measuring

Asset Value

•Since

accounting statements begin with the historical cost at which assets were

acquired and financing raised, they are not designed to measure the current

value of assets.

•The

only assets that are reported at or close to market value are current assets.

•As

a consequence, the liabilities and the shareholder’s equity from an accounting

statement are not measures of the current values of either.

•Fair

value accounting, a trend in the US and internationally, aims to bring asset

values in accounting balance sheets close to their current market values.

Income

Statement

Principles

Underlying Income Statement

•In

accrual accounting, the revenue from selling a good or service is performed. A

corresponding effort is made on the expense side to match expenses to

revenues.

•Expenses

are categorized into operating, financing, and capital expenses.

- Operating expenses are expenses that provide benefits only for the current period; costs of labor and materials spent to create products that are sold in the current period is a good example.

- Financial expenses are expenses arising from non-equity financing used to raise-capital for the business, most common example is interest expense

- Capital expenses are expenses that are expected to generate benefits over multiple periods; for instance, the cost of property, plant, and equipment.

- Operating expenses are expenses that provide benefits only for the current period; costs of labor and materials spent to create products that are sold in the current period is a good example.

- Financial expenses are expenses arising from non-equity financing used to raise-capital for the business, most common example is interest expense

- Capital expenses are expenses that are expected to generate benefits over multiple periods; for instance, the cost of property, plant, and equipment.

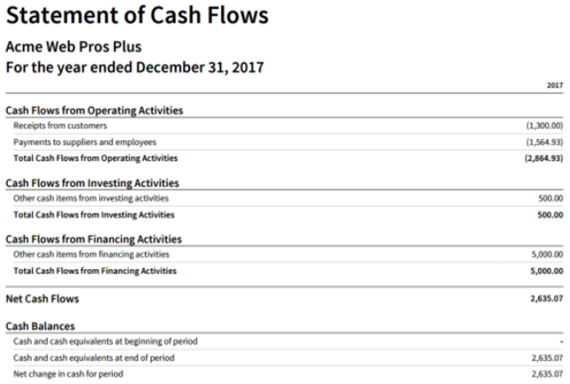

Statement

of Cash Flows

Valuation

Cash Flows

The cash flow statement is distinct from

the income statement and balance sheet because it does not include the amount

of future incoming and outgoing cash that has been recorded on credit.

Therefore, cash is not the same as net income, which on the income statement

and balance sheet, includes cash sales and sales made on credit.

•Operations

- Measuring the cash inflows and outflows caused by core business operations, the operations component of cash flow reflects how much cash is generated from a company's products or services. Generally, changes made in cash, accounts receivable, depreciation, inventory and accounts payable are reflected in cash from operations.

- Measuring the cash inflows and outflows caused by core business operations, the operations component of cash flow reflects how much cash is generated from a company's products or services. Generally, changes made in cash, accounts receivable, depreciation, inventory and accounts payable are reflected in cash from operations.

•Investing

- Changes in equipment, assets, or investments relate to cash from investing. Usually, cash changes from investing are a "cash out" item, because cash is used to buy new equipment, buildings, or short-term assets such as marketable securities. However, when a company divests of an asset, the transaction is considered "cash in" for calculating cash from investing.

- Changes in equipment, assets, or investments relate to cash from investing. Usually, cash changes from investing are a "cash out" item, because cash is used to buy new equipment, buildings, or short-term assets such as marketable securities. However, when a company divests of an asset, the transaction is considered "cash in" for calculating cash from investing.

•Financing

- Changes in debt, loans or dividends are accounted for in cash from financing. Changes in cash from financing are "cash in" when capital is raised, and they're "cash out" when dividends are paid. Thus, if a company issues a bond to the public, the company receives cash financing; however, when interest is paid to bondholders, the company is reducing its cash.

- Changes in debt, loans or dividends are accounted for in cash from financing. Changes in cash from financing are "cash in" when capital is raised, and they're "cash out" when dividends are paid. Thus, if a company issues a bond to the public, the company receives cash financing; however, when interest is paid to bondholders, the company is reducing its cash.

Last modified: Tuesday, August 14, 2018, 8:38 AM