Reading: Corporate Income Taxes

Corporate

Tax Rates

•Corporate

tax rates in the United States are progressive

- Marginal rates from 15% to 39%, depending on taxable income.

- US corporate tax rate structure has 8 brackets

- There are a number of “tax bubbles” – these occur when tax rate schedules recapture savings from prior brackets.

- Marginal rates from 15% to 39%, depending on taxable income.

- US corporate tax rate structure has 8 brackets

- There are a number of “tax bubbles” – these occur when tax rate schedules recapture savings from prior brackets.

•For

corporations with large income (more than $18.33 million) the rate is a flat

35%

•Qualified

personal service corps taxed at flat 35%

- Architects, CPA’s, consultants, etc

- Architects, CPA’s, consultants, etc

Corporate

Capital Gains

•A

corporation can choose from two alternative tax treatments on capital gains

- Tax at ordinary income

- Elect to pay an alternative tax (35%) on net long-term capital gain

- Tax at ordinary income

- Elect to pay an alternative tax (35%) on net long-term capital gain

•Essentially

equivalent to maximum regular corporate tax, no tax benefit to LTCG.

•Bottom

line: there is no difference in tax on ordinary vs capital income

Dividends

Received Deduction.

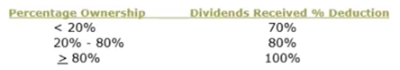

•Corporations

are allowed a deduction for a percentage of the dividends received from other

corporations

- Attempt to alleviate triple taxation

Dividends

received deduction is allowed based upon ownership- Attempt to alleviate triple taxation

Organizational

Expenditures & Start Up Costs

•Organizational

expenditures pertain to LLC’s, corporations and partnerships.

•Start

up costs can be incurred by any organization, including a sole proprietorship

and entities mentioned above.

•Examples

of these type of costs include

- Investigatory costs to look at a business before deciding whether or not to pursue it

- Legal/accounting services incidental to organization, costs of a temporary board of directors and state incorporation fees.

- Those incurred prior to opening – such as advertising expenses, employee training costs, etc.

- Investigatory costs to look at a business before deciding whether or not to pursue it

- Legal/accounting services incidental to organization, costs of a temporary board of directors and state incorporation fees.

- Those incurred prior to opening – such as advertising expenses, employee training costs, etc.

•Also

investigatory expenses – those incurred to decide whether to actually pursue

the business opportunity at hand.

Amortization

of Organizational Expenditure & Start Up Costs

•Organizational

expenditures and start up costs are capitalized and then amortized over 180

months.

•However,

firms can elect to deduct up to $5,000 of organization costs in the year the

firm begins business

- $5,000 amount is reduced $1 for each $1 that organizational expenses exceed $50,000

- $5,000 amount is reduced $1 for each $1 that organizational expenses exceed $50,000

Last modified: Tuesday, August 14, 2018, 8:39 AM