Reading: The Residual Distribution Model

The

Residual Distribution Model

•When

deciding how much cash to distribute to stockholders, two points should be kept

in mind:

(1) The overriding objective is to maximize shareholder value

(2) the firm’s cash flows really belong to its shareholders, so a company should not retain income unless managers can reinvest that income to produce returns higher than shareholders could themselves earn by investing the cash in investments of equal risk.

(1) The overriding objective is to maximize shareholder value

(2) the firm’s cash flows really belong to its shareholders, so a company should not retain income unless managers can reinvest that income to produce returns higher than shareholders could themselves earn by investing the cash in investments of equal risk.

•On the

other hand, keep

in mind that internal

equity (reinvested earnings) is cheaper than external equity (new common stock

issues) because it avoids flotation costs and adverse signals. This encourages

firms to retain earnings so as to avoid having to issue new stock.

•When

establishing a distribution policy, one size does not fit all. Some firms

produce a lot of cash but have limited investment opportunities—this is true

for firms in profitable but mature industries in which few opportunities for

growth exist.

•Such

firms typically distribute a large percentage of their cash to shareholders,

thereby attracting investors that prefer high dividends.

•Other

firms generate little or no excess cash because they have many good investment

opportunities. Such firms generally don’t distribute much cash but do enjoy

rising earnings and stock prices, thereby attracting investors who prefer

capital gains.

•Dividend

payouts and dividend yields for large corporations vary considerably.

Generally, firms in stable, cash-producing industries such as utilities

or financial

services

pay

relatively high dividends, whereas companies in rapidly growing industries such

as computer software tend to pay lower dividends.

•For a

given firm, the optimal distribution ratio is a function of four factors:

(1) investors’ preferences for dividends versus capital gains

(2) the firm’s investment opportunities

(3) its target capital structure

(4) the availability and cost of external capital. The last three elements are combined in what we call the residual distribution model.

(1) investors’ preferences for dividends versus capital gains

(2) the firm’s investment opportunities

(3) its target capital structure

(4) the availability and cost of external capital. The last three elements are combined in what we call the residual distribution model.

•Under

this model a firm follows these four steps when establishing its target

distribution ratio:

(1) it determines the optimal capital budget

(2) it determines the amount of equity needed to finance that budget, given its target capital structure

(3) it uses reinvested earnings to meet equity requirements to the extent possible

(1) it determines the optimal capital budget

(2) it determines the amount of equity needed to finance that budget, given its target capital structure

(3) it uses reinvested earnings to meet equity requirements to the extent possible

•(4)

it pays dividends or repurchases stock only if more earnings are available than

are needed to support the optimal capital budget.

•The

word residual implies “leftover,” and the residual policy implies that

distributions are paid out of “leftover” earnings.

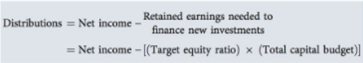

•If

a firm rigidly follows the residual distribution policy, then distributions

paid in any given year can be expressed as follows:

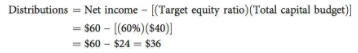

•Consider

the

case of Texas and Western (T&W) Transport Company, which has $60 million in

net income and a target capital structure of 60% equity and 40% debt.

•If

T&W forecasts poor investment opportunities, then its estimated capital

budget will be only $40 million. To maintain the target capital structure, 40%

($16 million) of this capital must be raised as debt and 60% ($24 million) must

be equity. If it followed a strict residual policy, T&W would retain $24

million of its $60 million earnings to help finance new investments and then

distribute the remaining $36 million to shareholders:

Last modified: Tuesday, August 14, 2018, 8:54 AM