Reading: Anatomy of a Recapitalization

Anatomy

of a Recapitalization

•Strasburg

should recapitalize, meaning that it should issue enough additional debt to

optimize its capital structure, and then use the debt proceeds to repurchase

stock. As shown in a previous Figure, a capital structure with 40% debt is

optimal. But before tackling the recap, as it is commonly called, let’s

consider the sequence of events, starting with the situation before Strasburg

issues any additional debt.

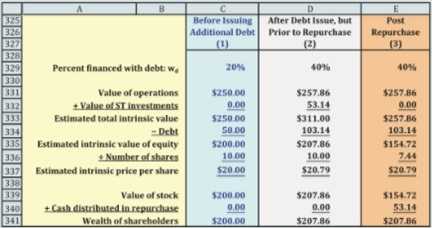

•The valuation

analysis of Strasburg at a capital structure consisting of 20% debt and 80%

equity. These results are repeated in Column 1, along with the shareholder wealth, which

consists entirely of $200 million in stock before the repurchase. The next step

is to examine the impact of Strasburg’s debt issuance.

•The

next step in the recap is to issue debt and announce the firm’s intent to

repurchase stock with the newly issued debt. At the optimal capital structure

of 40% debt, the value of the firm’s operations is $257.86 million as shown in

the Figure above. This value of operations is greater than the $250 million

value of operations for wd =

20% because the WACC is lower.

•Notice

that

Strasburg raised its debt from $50 million to $103.14 million, an increase of

$53.14 million. Because Column 2 reports data prior to the repurchase,

Strasburg has short-term investments in the amount of $53.14 million, the

amount that was raised in the debt issuance but that has not yet been used to

repurchase stock. As the chart

shows,

Strasburg’s intrinsic value of equity is $207.86 million.

•Because

Strasburg has not yet repurchased any stock, it still has 10 million shares

outstanding. Therefore, the price per share after the debt issue but prior

to

the repurchase is:

•Column

2 of the Figure above summarizes these calculations and also shows the wealth

of the shareholders. The shareholders own Strasburg’s equity, which is worth

$207.86 million. Strasburg has not yet made any cash distributions to

shareholders, so the total wealth of shareholders is $207.86 million. The new

wealth of $207.86 million is greater than the initial wealth of $200 million,

so the recapitalization has added value to Strasburg’s shareholders. Notice

also that the recapitalization caused the intrinsic stock price to increase

from $20.00 to $20.79.

•Summarizing

these results, we see that the issuance of debt and the resulting change in the

optimal capital structure caused (1) the WACC to decrease, (2) the value of

operations to increase, (3) shareholder wealth to increase, and (4) the stock

price to increase.

Last modified: Tuesday, August 14, 2018, 8:55 AM