Reading: Business Risk and Operating Leverage

Business

Risk and Operating Leverage

•Business

risk is the risk a firm’s common stockholders would face if the firm had no

debt.

•In

other

words, it is the risk inherent in the firm’s operations, which arises from

uncertainty about future operating profits and capital requirements. Business

risk depends on a number of factors, beginning with variability in product

demand and production costs.

•If

a

high percentage of a firm’s costs are fixed and hence do not decline when

demand falls, then the firm has high operating leverage, which increases its

business risk.

•A

high degree of operating leverage implies that a relatively small change in

sales results in a relatively large change in EBIT, net operating profits after

taxes (NOPAT), return on invested capital (ROIC), return on assets (ROA), and

return on equity (ROE).

•Other

things

held constant, the higher a firm’s fixed costs, the greater its operating

leverage. Higher fixed costs are generally associated with (1) highly

automated, capital intensive firms; (2) businesses that employ highly skilled

workers who must be retained and paid even when sales are low; and (3) firms

with high product development costs that must be maintained to complete ongoing

R&D projects.

•To

illustrate the relative impact of fixed versus variable costs, consider

Strasburg Electronics Company, a manufacturer of components used in cell

phones. Strasburg is considering several different operating technologies and

several different financing alter- natives. We will analyze its financing

choices in the next section, but for now we will focus on its operating plans.

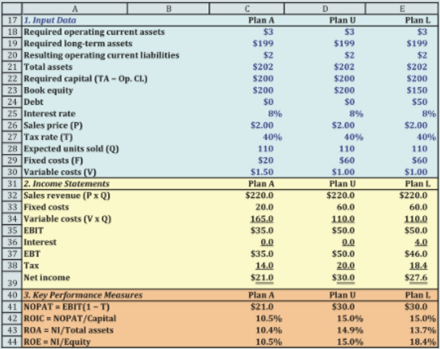

•Strasburg

is comparing two plans, each requiring a capital investment of $200 million;

assume for now that Strasburg will finance its choice entirely with equity.

Each plan is expected to produce 110 million units (Q) per year at a sales

price (P) of $2 per unit. Plan A’s technology requires a smaller annual

fixed cost (F) than Plan U’s, but Plan A has higher variable costs (V). (We

denote the second plan with U because it has no financial leverage, and we

denote the third plan with L because it does have financial leverage; Plan L is

discussed in the next section.) The projected income statements and selected

performance measures for the first year. Notice that Plan U’s performance

measures are superior to Plan A’s if the expected sales occur.

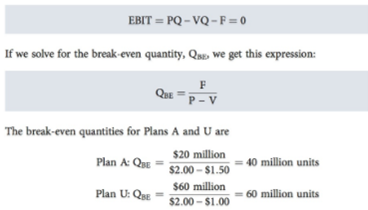

•Plan

A

will be profitable if unit sales are above 40 million, whereas Plan U requires

sales of 60 million units before it is profitable. This difference occurs

because Plan U has higher fixed costs, so more units must be sold to cover

these fixed costs. Panel a of the Figure below illustrates the operating

profitability of these two plans for different levels of unit sales. Because

these companies have no debt, the return on assets measures operating

profitability; we report ROA instead of EBIT to facilitate comparisons.

Last modified: Tuesday, August 14, 2018, 8:55 AM